Maximum Home Office Deduction 2024 – The IRS has released the 2024 standard deduction amounts that you’ll use for your 2025 tax return. Knowing the standard deduction amount for your filing status can help you determine whether you . Additionally, the IRS adjusted its standard deduction for 2024 for the lowest income bracket in the 2024 tax year has a maximum credit of $7,830 for three or more children — an increase .

Maximum Home Office Deduction 2024

Source : www.forbes.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

MWCIA Home

Source : www.mwcia.org

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

20 Popular Tax Deductions and Tax Credits for 2023 2024 NerdWallet

Source : www.nerdwallet.com

Saving for college: The new 529 to Roth IRA transfer rule

Source : www.journalofaccountancy.com

The Home Office Deduction TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

401(k) Contribution Limits In 2023 And 2024 | Bankrate

Source : www.bankrate.com

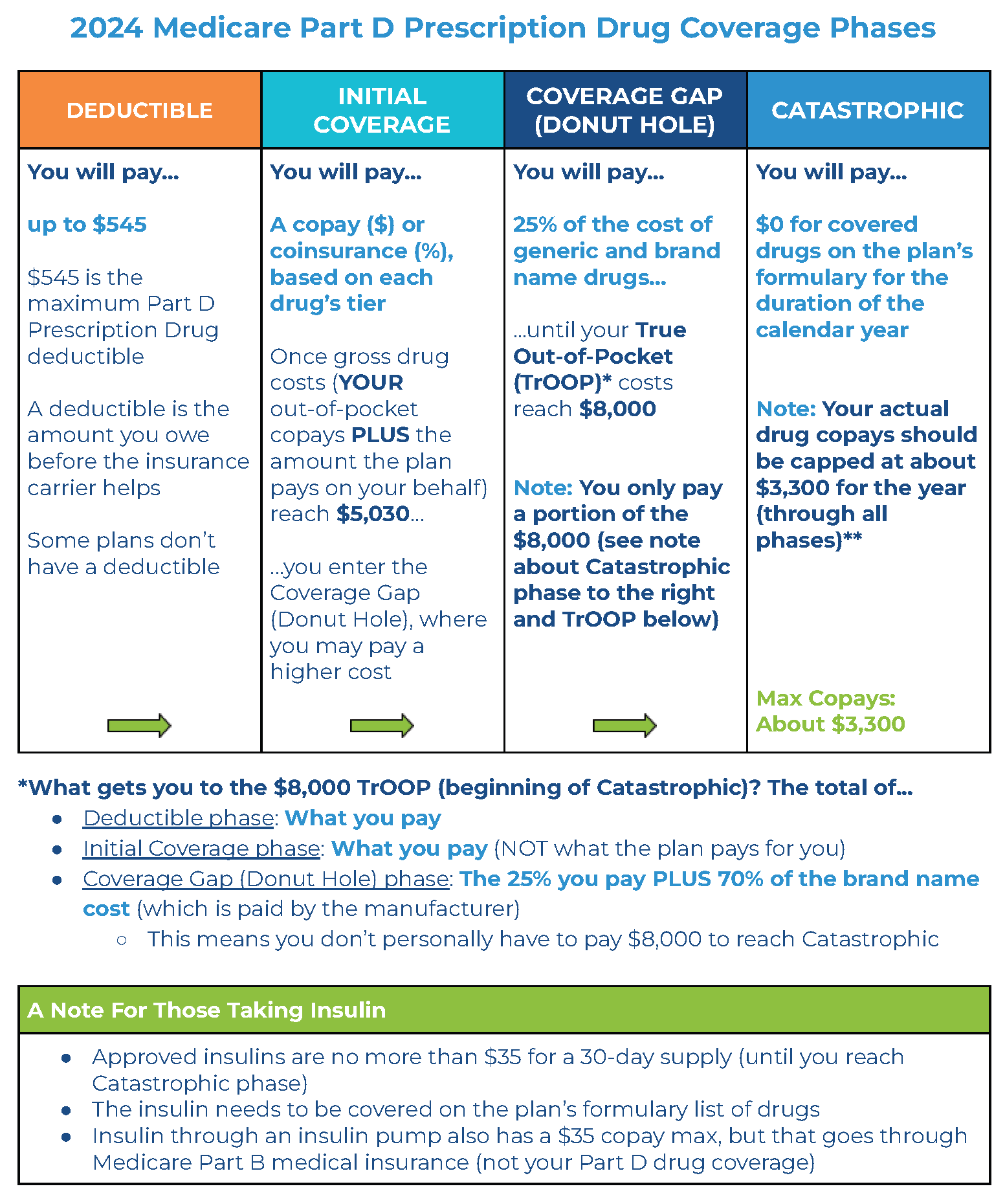

How Medicare Part D Works (2024) — Medicare Mindset, LLC

Source : www.medicaremindset.com

Maximum Home Office Deduction 2024 Your First Look At 2024 Tax Rates: Projected Brackets, Standard : There are certain things you can do—at tax time and throughout the year—to maximize your tax benefits and minimize your taxes due. Here are our 10 top tips. . Many student loans will be entering repayment this month. For 2024, the $2,500 maximum deduction for interest paid on qualified education loans will begin to phase out for taxpayers with modified .

More Stories

Freedom Festival 2024 Provo

Big Krit Tour 2024

Martin Luther Weekend 2024